5-mile drive or 5 quick clicks? Multiple stops or 1 online shop? Scouring through aisles or typing out a simple search? Today’s purchasing decisions often present these dilemmas, and shopping on Amazon makes it easy to choose the latter.

We all know by now that Amazon is dominating the online retail industry. They have mastered getting products to your door fast with the touch of only a few buttons. Now, you can get everything you need from the comfort of your couch. Who can beat that? (Of course, the measures Amazon takes to make this distribution happen certainly raise other concerns, but that is an article for a different day.)

There are around 166 million Amazon Prime members in the United States who utilize the company’s ultra-fast shipping and often unbeatable deals every day. With Amazon’s ‘magic’ constantly at their fingertips, why shop anywhere else? We sought to understand how Prime members get their everyday shopping done – from Amazon, other online retailers, and in physical stores. Here is what we discovered in our consumer behavior survey from 200 Amazon Prime members across the United States.

Most of Prime Members’ total online shopping spend goes to Amazon

Respondents shared their estimated spend online (at all online retailers) per month, as well as solely on Amazon. Respondents spend an average of $400 per month on online shopping all together, and an average of $273 is from Amazon shopping. That means approximately 68.25% of Amazon Prime members’ online shopping spend is at Amazon. Over half (52%) of respondents place between 3-5 Amazon orders per month, with each order typically including 2-4 items (52%).

Our analysis uncovered that respondents often choose Amazon over other online retailers because of their better prices (91% theme support), better product variety (90% theme support), and free shipping (89% theme support).

Respondents said that they choose to buy on Amazon because they “…like the variety of items available” (95% support) and “Amazon offers faster shipping than any other online retailer” (91% support). With Amazon’s unmatched prices, variety, and shipping, it is clear why these respondents spend most of their online shopping at Amazon. Find more reasons why respondents prefer Amazon below.

Why do you prefer to buy these products on Amazon as opposed to other online retailers?

Respondents are ditching the mall. The majority prefer to shop online for clothing, shoes, and jewelry

Remember when the mall was the place to be on the weekend? These Amazon Prime members seem to have left those days behind them. Although foot traffic at malls is picking up post-COVID, still “…more than half of Americans identify online shopping as their preferred channel.” Our data agrees – 68% of respondents say they prefer to shop for clothing, shoes, and jewelry online as opposed to a physical store.

What kinds of products do you prefer to purchase online as opposed to a physical store?

Further, 53% of respondents prefer to buy clothing, shoes, and jewelry on Amazon as opposed to other online retailers. This preference for Amazon is quite remarkable, considering there are endless online retailers that specialize in fashion and accessories. Still, those who prefer Amazon’s clothing, shoes, and jewelry are drawn to the better prices (96% theme support), availability (93% theme support), and variety (92% theme support).

Why do you prefer to buy clothing, shoes, and jewelry on Amazon as opposed to other online retailers?

Amazon Prime members still have their eye on competitors like Walmart and Target

Although these Prime members seem to be loyal and satisfied with Amazon’s online shopping, they are still browsing other sites. In fact, 76% claim that they regularly shop online at Walmart and 48% regularly shop online at Target.

Where, besides Amazon, do you regularly shop online?

When asked about their most recent Amazon purchase, 47% of respondents shared that they considered buying the product from Walmart and 22% considered buying from Target instead. However, 23% did not consider buying from anywhere but Amazon.

Before you placed your order, where else did you consider purchasing this product? Select all that apply.

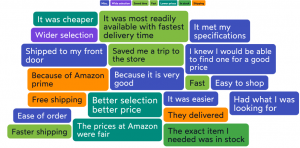

Respondents ultimately decided to purchase from Amazon because of the “Better selection, better prices” (95% support) and it “Had what [they were] looking for” (91% support). Many respondents also agreed that the “…shipping option” (90% support) convinced them to purchase from Amazon instead of competitors. Amazon seems to nail all the best parts of online shopping, and in turn, keeps online shoppers to themselves.

Why did you ultimately buy this product from Amazon?

What about grocery shopping online? Amazon Prime members are not fully convinced

To better understand what drives consumers to the store and away from ordering online, we asked them about their most recent in-store purchase. 34% of respondents said their most recent in-store purchase was grocery related.

They chose to buy in-store rather than on Amazon because they “Needed the item immediately” (93% support) or were simply “…hungry” (86%). Despite Amazon Fresh promoting free 2-hour delivery on orders over $35, the service still does not seem to be fast enough for Prime members like it is in other product categories.

Consumers even seem to long for a physical connection to the food they are purchasing; 56% say that they were deterred from ordering groceries on Amazon because they “Wanted to touch it” before purchasing. Others “like to pick out their own vegetables and meat” (91% support) and “do not like substitutions” (69% support). Sometimes, you need to find the perfectly ripe avocado or banana yourself, and because of this, consumers may never be totally satisfied with someone else doing their grocery shopping.

Why did you not purchase your groceries on Amazon?

Themes suggest Prime members will stay committed to Amazon

61% of our respondents have been Amazon Prime members for at least 2 years, and based off their responses, they seem to plan to stick around. Themes like convenience, availability, price, and shipping time continue to draw these consumers back to Amazon in almost every product category.

Although physical stores appeal to customers for certain categories like groceries, most shopping has transitioned online. As Amazon and its competitors continue to improve their systems, we can only predict that consumerism will rely even more on the web.

At times it seems that Amazon commands the world’s marketplace. In many ways, the data suggests that no competitor can match Amazon’s ability to satisfy their customers. However, the data also shows that there are windows of opportunity for retailers to change Prime members’ minds. Some items are needed faster than even Amazon can accomplish, or consumers crave a physical connection to a product before purchasing, for example. Leaning into these spaces can help other retailers navigate through Amazon’s e-commerce dominance.