With cases in the U.S. on the rise and a second wave approaching, consumers are anxiously waiting to see what happens next.

We are now navigating into our 12th COVID-19 pulse check since we first started in March. At first, we were extremely fearful of the virus, causing some to pantry-load in order to avoid outside exposure. Now, we are used to living in a pandemic, with grocery shopping being our main outlet of socialization for many of us. However, we are also aware that things are far from over, with potentially worse to come.

What is going to happen to schools? Restaurants? Stores? Our everyday routines? And even more so, when will this be over? With the help of Mary Cooper from IRI Growth Consulting, we have delved into these questions to better understand U.S. consumer sentiment during this challenging time.

Pulse check on June 25: On the edge of our seats.

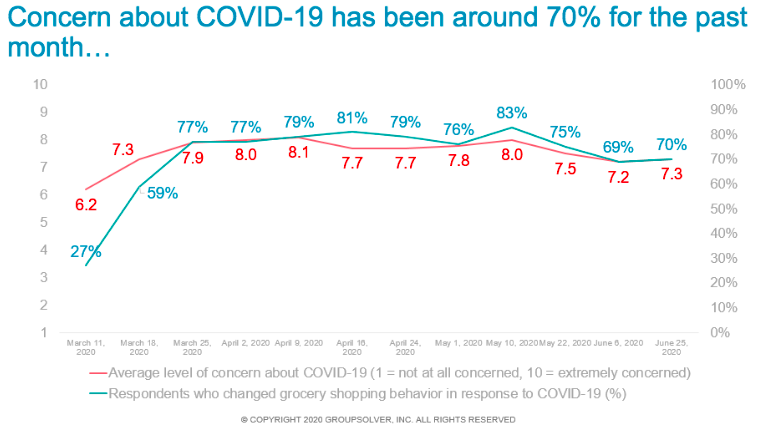

Balbina De La Garza, GroupSolver: So, we are now at pulse check 12! Starting off, I’d like to go over the concern level as we usually do. Concern is still high at around 70%, but it is certainly lower than it was at one point a few weeks ago. My understanding of this is that people are still worried, but even the word ‘pandemic’ doesn’t seem to be as scary as it used to be.

Mary Cooper, IRI: Yes, concern has recently dipped a bit but overall, it’s pretty stable.

BD: Online purchasing this time around is still the same as it was in the beginning of June. What has shifted, though, is the number of those who are doing takeout and delivery. That has certainly increased. This makes me think that people are bored of being stuck at home and only eating home-cooked meals.

MC: It’s interesting that for online grocery shopping, it peaked and then tapered back off. It tells me that people are still interested in going into the physical stores. For takeout and delivery, I align with your thoughts. At first, people started eating more at home and getting creative because they felt the need to respond to the pandemic. Now, some people are bored of the same thing and tired of the extra work of food preparation at home. And of course, there are those who want to support local businesses—they don’t want to see them fail.

BD: I agree with that. People may be willing to risk it a little bit and step outside to support local businesses since this pandemic is going for the long run. This ties in with our next chart where we see that almost double the number of respondents reported to have eaten at a sit-down restaurant. This may be because as we mentioned, we are tired of just staying home and some are feeling more comfortable living their lives as usual.

MC: Also, many states are opening up. It’s all three of those dynamics in play.

BD: Certainly! Compared to the beginning of this month, although more people are eating out at sit-down restaurants, way more people are noting that they will expect to eat out much less frequently, if at all, in the next several weeks. It feels like we are much more comfortable with takeout. Or perhaps some restaurants are just not allowing people back in.

MC: That’s another good point. Not all of them are opening up. It’s hard for some business models to make it work when they can only have limited seating inside or outside. It’s very expensive for them to open. But with it now being summer, there are some restaurants getting more creative with their outside seating options.

BD: I now want to look over the insights from the education questions we asked because I find them so interesting. Unsurprisingly, most children had their school shifted online.

BD: 47% of parents felt their children learned less doing online classes, while 32% felt they learned more. Those who liked online more were mainly for reasons like safety. However, some felt that it was actually a better learning environment, which was fascinating to me.

MC: I am very surprised by this metric. I’ve heard from many teachers that they can’t hold the kids’ engagement for that long online. Let’s say school is 4-5 hours a day online. It’s hard for me as an adult to be online for that long! I think online learning is safer, but I don’t understand how they learn more.

Question: Why do you prefer online learning for your child(ren)?

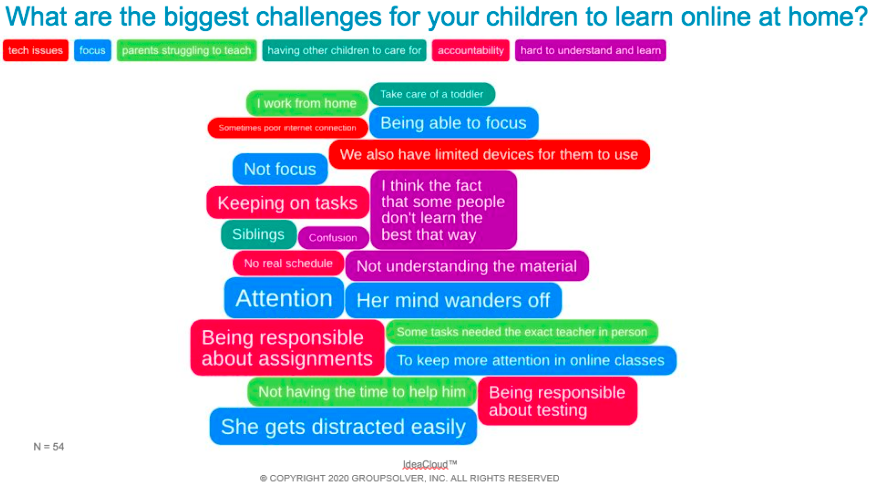

BD: Well on the other side, we also had parents who noted the challenges with online learning. Some of the biggest challenges are socialization, being able to focus, staying on task, and simply understanding the material.

MC: I completely align with this finding. It’s hard for those kids to pay attention and be responsible when they are expected to independently engage for long periods of time online. The “texture” of in-person and group dynamics get lost.

BD: For sure. I think it could also depend on age. It may be easier for students who are 17 or 18 in high school versus a 10-year-old.

Question: What are the biggest challenges for your children to learn online at home?

BD: I want to touch on the length expectancy for this pulse check, too. For the last few studies, the median expected duration was at 20 weeks. But now it has risen to 26 weeks! I’m wondering if this has to do with the fact that we are most likely going to experience a second wave. But I am also curious if this is what folks think that the first wave is going to last for, or if this includes the second wave.

MC: Before, it was expected to last 12 weeks, then 16, then 20 and now 26 weeks. At one point I was optimistic that we were going to get a little break during the summer, before we get a new wave in the fall. But now with a resurgence in some of these warm climate areas, I am starting to think that we won’t get a break but instead power through until we get that vaccine.

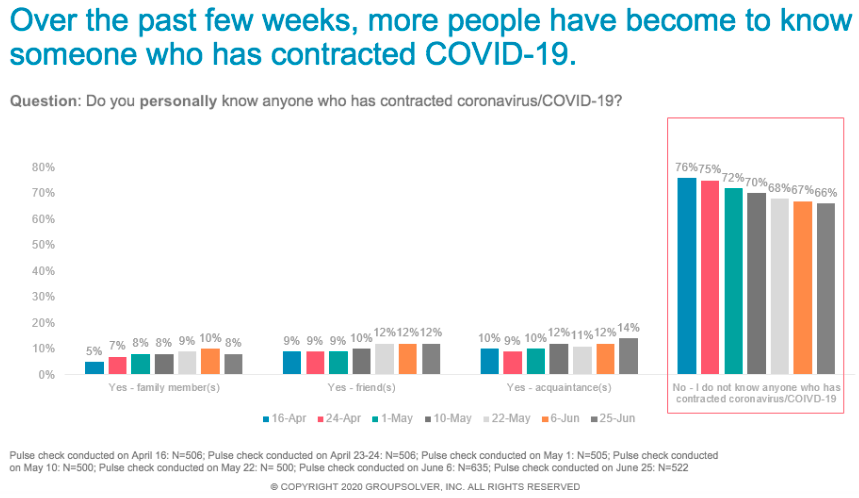

BD: The last thing I want to bring up is this chart. We are seeing that more people know someone in their lives who has contracted COVID-19. It makes me a little uneasy because although 66% is still a relatively high number of those who don’t know anyone, this percentage is on a continuous decline. It’s important to recognize that this is very real, and unfortunately it may hit home for some of us.

MC: In addition, a lot more people have access to testing now. I think more people are also willing to talk about the fact that they have it. People are less afraid of being judged for it. These numbers are still going to climb.

BD: I agree. This is the reality we are in.

~

Mary Cooper is a Senior Principal at IRI Growth Consulting with a focus on CPG and Retail. Balbina De La Garza is a Marketing Coordinator at GroupSolver.

Do you have a customer insight question you would like solved? #FridayInSight has your answer! We’ll design a study, collect data on the GroupSolver® platform, and share with you a free report with our findings. Contact us at marketing@groupsolver.com.